The market remained in a strong uptrend with the benchmark indices hitting fresh record highs on November 10, backed by banking and financials and consistent FII inflow. Positive global cues following further progress on the COVID vaccine front also lifted sentiment.The BSE Sensex surged 680.22 points or 1.60 percent to end at a record closing high of 43,277.65, while the Nifty50 rallied 170.10 points or 1.37 percent to 12,631.10 and formed a bullish candle on the daily charts. The indices climbed over 8 percent in seven consecutive sessions.”Though Nifty placed at the new all-time high of 12,643 levels, there is no indication of any reversal pattern yet at the highs, as per daily and intraday timeframe chart. This is a positive indication and one may expect further upside in the market in short term,” Nagaraj Shetti, Technical Research Analyst at HDFC Securities added.”Daily RSI has moved above 70 and there is some room left for this indicator to top out and weekly RSI is now moving above 60 levels. This action of RSI could signal some more upside for the market ahead,” he said.”The next upside level to be watched is around 12,800 for the next few sessions. Immediate support is now placed at 12,550,” he added.However, the broader markets continued to underperform frontliners as the Nifty Midcap index was up 0.3 percent and Smallcap ended flat with a negative bias.We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the NiftyAccording to pivot charts, the key support levels for the Nifty is placed at 12,522.9, followed by 12,414.7. If the index moves up, the key resistance levels to watch out for are 12,691.6 and 12,752.1.

Nifty BankThe Bank Nifty sharply outperformed the Nifty50, jumping 1071.90 points or 3.89 percent to 28,606 on November 10. The important pivot level, which will act as crucial support for the index, is placed at 28,081.1, followed by 27,556.2. On the upside, key resistance levels are placed at 28,966.7 and 29,327.4.

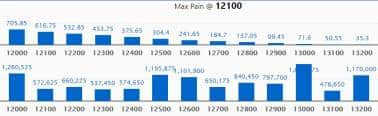

Call option dataMaximum Call open interest of 16.77 lakh contracts was seen at 13,000 strike, which will act as crucial resistance level in the November series.This is followed by 12,000 strike, which holds 12.60 lakh contracts, and 12,500 strike, which has accumulated 11.95 lakh contracts.Call writing was seen at 13,500 strike, which added 9.95 lakh contracts, followed by 13,200 strike which added 8.47 lakh contracts and 13,100 strike which added 2.63 lakh contracts.Call unwinding was seen at 12,900 strike, which shed 4.37 lakh contracts, followed by 12,500 strike which shed 3.38 lakh contracts and 12,400 strike which shed 2.22 lakh contracts.

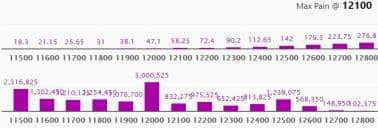

Put option dataMaximum Put open interest of 30 lakh contracts was seen at 12,000 strike, which will act as crucial support in the November series.This is followed by 11,500 strike, which holds 23.16 lakh contracts, and 11,600 strike, which has accumulated 13.02 lakh contracts.Put writing was seen at 12,500 strike, which added 6.57 lakh contracts, followed by 12,600 strike, which added 4.87 lakh contracts and 12,000 strike which added 2.65 lakh contracts.Put unwinding was seen at 11,500 strike, which shed 1.84 lakh contracts, followed by 11,600 strike, which shed 32,625 contracts and 12,200 strike which shed 20,850 contracts.

Stocks with a high delivery percentageA high delivery percentage suggests that investors are showing interest in these stocks.

38 stocks saw long build-upBased on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

20 stocks saw long unwindingBased on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

33 stocks saw short build-upAn increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

45 stocks witnessed short-coveringA decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.