Suyash Choudhary, Head – Fixed Income, IDFC AMC

The Set-Up

Most of the year so far has been about trying to find policy rate peaks in major developed markets (DMs). Expectations here have been continually frustrated thus far as inflation has proven much more resilient than was being previously expected. There was one plateauing of expectations around the middle of June, post which rate forecasts were actually reduced under a mistaken impression of policy pivots. However, the illusion was broken by September as a spate of ugly inflation prints drove peak rate and peak inflation theses to the waste paper bin. This set the stage for a further leg higher in DM rate pricing and, contrary to many expectations (including our own), a meaningful one. This evolution is captured below in the chart that depicts the incessant rise in US and German 2 year bond yields.

The frustration here, macro-economically speaking, has been that while signs of economic breakage have abounded, they nevertheless haven’t been widespread and consistent enough to arrest the pace of DM central bank tightening. Thus, for example, even as the housing sector continues to bleed in the US, overall growth seemed to have bounced back smartly in the third quarter. While the downshift in the jobs market is evident the relative tightness has refused to ease much so far, and while wage growth pressures have eased somewhat they still are much more elevated than what is consistent with 2% overall inflation.

A key reason for this, one that was always in play but the potency of its effect was hard to quantify, is just the nature of the pandemic response fiscal stimulus in the US. Unlike the post Global Financial Crisis fiscal expansion, a significant portion of the pandemic stimulus involved direct cash transfers to members of the public. The quantum involved was large enough to provide strong safety cushions to consumers for a length of time. This has possibly delayed the transmission of rate tightening to growth and inflation in two ways: One, consumer demand has been more resilient to higher prices. In fact an important discussion in the US today is that company margins are still unnaturally high in general, and are a key contributor to concurrent inflation. Thus there was already a cost-push aspect owing to Covid and the war, but there is an additional build-up due to companies’ passing on more than just cost escalations. Two, there may be more near term headwinds to labour supply, ceteris paribus, with higher safety cushions now in play for employment seekers.

Whatever be the reasons, the fact remains that the Fed needs definitive evidence of softening from the labour market, and this hasn’t been forthcoming thus far. It is to be noted, however, that while the rate thresholds may have increased for tightening and transmission lags may be longer partly for the reasons discussed above, the process itself is likely to be alive and well. Additionally, since the pace of this tightening cycle in major DMs has been unprecedented, and financial conditions have tightened significantly over a relatively short period of time, the lagged impact of this on economic activity could also then be, ceteris paribus, higher. The question then, and one that inevitably rings a feeling of déjà vu, is this: has enough been priced in on terminal rates now?

Observations

The key source of imported tightening for emerging markets (EMs) including India for most of this year has been on account of the rise and rise of the US dollar. This in turn has been triggered by the continuous reiteration higher in US terminal rate expectations, and the associated rise in bond yields, the dynamics of which have been discussed above. Even accounting for our view that the RBI needn’t be lock-step with the Fed (https://idfcmf.com/article/9850), our expectation of terminal RBI repo rate has had to take into account spill-over risks from abroad. This has led us to now expect higher peak repo rate than what we believed say in September.

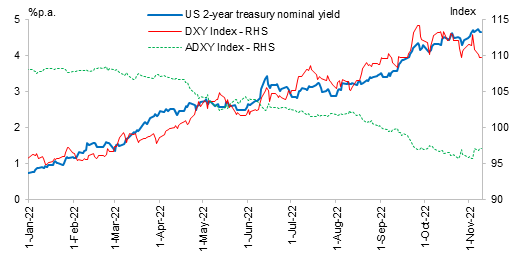

For the world to begin to stabilise, the dollar has to give its approval. Therefore, the incremental sensitivity of the dollar to evolving data is of much relevance. Here, there is tentative good news. While US 2 year bond yield (loosely signifying policy rate expectations in the current cycle) has made a fresh year’s high recently, the dollar index is appreciably lower than where it was in late September. While this has also to do with the relative hawkishness of other DM central banks, many of these (barring may be ECB) seem to be lately more appreciative of two-way risks to their incremental tightening cycle. Further, even the Asia Dollar Index seems to have not been responding to the last leg of rise in US yields and rate hike expectations. These are shown in the chart below:

Of course, this could change. The problem with the hyper-strung nature of the world is that any of 4 – 5 key data points over the course of a monthly release calendar can be fuel for change. However, for the time being, the signs seem encouraging. The key now to look for is the extent to which incremental hawkish data, if it comes, changes both the dollar index as well as US rate hike expectations. The somewhat reasonable hypothesis one is working with here is that at some juncture valuations start to reduce volatility. Put another way, with terminal Fed funds rate expectation now roughly double of what is considered long term neutral nominal rates, the bar for further upward resets naturally moves much higher.

The other observation, dangerously veering into the territory of view but still stands to common logic, is that higher the terminal rate achieved the higher the probability of rate cuts later. This is consistent with the Fed’s guidance for ‘higher for longer’ and only seeks to answer ‘this high for how long’ in a scenario where the definition of ‘this high’ has moved up another 150 bps higher (from 3.75% to 5.25 % now) in a matter of weeks. Unless long term neutral itself has changed very materially (some change inevitable, too much change not), at some juncture the journey from cycle peak to long term neutral will begin. It may stop short of it basis the nature of the evolution of the cycle, but begin it must. Put another way at some point the discussion changes from ‘how high for how long’ to ‘how much off highs and over how long’. While hard to think of now, it is possible that as the lags on monetary policy affecting growth get closed, market attention starts to focus in this direction. Just as market pricing in yields and the dollar index have led actual Fed tightening, it will likely do so on the way down as well. Thus, even as the Fed may only start ‘thinking about thinking about’ rate cuts very late next year, market pricing may not wait that long. That said, it is reasonable to assume that the current bar for the Fed to allow any loosening in financial conditions via a change in market expectations of its tightening is fairly high.

Indian Context

We have presented detailed arguments on our view of RBI not needing to be in lock-step with Fed before. Subsequently, two external members of the MPC seem to have echoed our logic with both likely to vote for a pause in the upcoming December policy (even as we still expected a final 25 – 35 bps hike in December). A third external member was still hawkish but will likely vote for a scaling down on the pace of normalization (that is vote for less than 50 bps hike). An internal RBI member was debating 35 bps or 50 bps for the September meeting itself, which seems to suggest he would be unlikely to vote for a full 50 bps in December. The one caveat is that these observations are basis their last heard views which may have undergone modification by now. A potential reason for some modification, apart from Fed rate expectations having gone further up (may not be material for two external members), is that India’s local food inflation pressures have inched up. Basis available data, our own forecast of Oct-Dec average CPI is around 40 bps higher than RBI’s projection of 6.5%.

It is possible that there is some upward shift in our own terminal repo rate expectations basis the above. The bigger point though is that so long as terminal is 6.50% centric, it can be argued that sovereign bond valuations at the front end have largely adjusted for this. This will be especially true if imported volatility starts to subside for reasons mentioned above and if recent observations in this regard hold going forward. In fact, the evolution of Indian bond yields has been quite interesting so far this year. The bulk of upward adjustment actually happened in the short period between April and June as market repriced the change in RBI reaction function. However, unlike many of their DM peers, Indian yields haven’t gone higher than their June highs; save for at the very front end which was to be expected as the rate cycle progressed. Indeed, while yields in the 5 year segment are similar to what they were in mid-June, those in 10 year and beyond are actually lower. The next two graphs compare the Indian yield curve between June and now, and the evolution of Indian yields versus US.

It is to be noted, however, that though we expect peak RBI to peak Fed differential to be lower in this cycle, we expect the differential to open up again over the time ahead. As discussed above, the Fed is peaking much higher than long term neutral. This is owing to much higher than usual inflation, the bulk of which is presumably cyclical. As inflation starts to come off, Fed policy rate will also start to move towards neutral over the next couple of years. On the other hand, since RBI is peaking not far from neutral it may have to hold rates there for longer.

Thus some of market’s rate differential concerns may get addressed not by RBI being in lockstep with Fed now but rather it holding rates at peak for much longer than the Fed, in our view. That said, market may still respond by compressing term premium between front end rates (up to 5 years) and policy rate during this period. Again, however, this is possibly trying to look too much into the future. For now one is only watchful for signs of volatility stabilising at a valuation which is quite comfortable so far as government bonds up to 5 years’ maturity are concerned.

Disclaimer:

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

The Disclosures of opinions/in house views/strategy incorporated herein is provided solely to enhance the transparency about the investment strategy / theme of the Scheme and should not be treated as endorsement of the views / opinions or as an investment advice. This document should not be construed as a research report or a recommendation to buy or sell any security. This document has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of IDFC Mutual Fund. The information/ views / opinions provided is for informative purpose only and may have ceased to be current by the time it may reach the recipient, which should be taken into account before interpreting this document. The recipient should note and understand that the information provided above may not contain all the material aspects relevant for making an investment decision and the security may or may not continue to form part of the scheme’s portfolio in future. Investors are advised to consult their own investment advisor before making any investment decision in light of their risk appetite, investment goals and horizon. The decision of the Investment Manager may not always be profitable; as such decisions are based on the prevailing market conditions and the understanding of the Investment Manager. Actual market movements may vary from the anticipated trends. This information is subject to change without any prior notice. The Company reserves the right to make modifications and alterations to this statement as may be required from time to time. Neither IDFC Mutual Fund / IDFC AMC Trustee Co. Ltd./ IDFC Asset Management Co. Ltd nor IDFC, its Directors or representatives shall be liable for any damages whether direct or indirect, incidental, punitive special or consequential including lost revenue or lost profits that may arise from or in connection with the use of the information.

If you have any objection to this press release content, kindly contact pr.error.rectification@gmail.com to notify us. We will respond and rectify the situation in the next 24 hours.